Bitcoin Halving: A Defining Event in Cryptocurrency

Bitcoin halving, a fundamental event in the world of cryptocurrencies, plays a crucial role in shaping the supply and value dynamics of Bitcoin. This phenomenon occurs approximately every four years and involves a reduction in the reward miners receive for validating transactions on the Bitcoin blockchain. The primary objective of halving is to gradually decrease the rate at which new Bitcoins are created, ultimately leading to a total supply cap of 21 million Bitcoins. The most recent halving occurred on May 11, 2020, reducing the block reward from 12.5 to 6.25 bitcoins. The upcoming halving, expected in April 2024, will further cut the reward to 3.125 bitcoins per block.

Causes of Bitcoin Halving:

Bitcoin halving is programmed into the cryptocurrency’s protocol as a deflationary mechanism. The halving event is triggered after every 210,000 blocks are mined, approximately every four years. This reduction in block rewards serves to increase scarcity and potentially drive up the value of Bitcoin over time. By limiting the rate at which new Bitcoins are introduced into circulation, halving emphasizes the digital asset’s scarcity, making it a sought-after store of value.

Historical Bitcoin Halving Events:

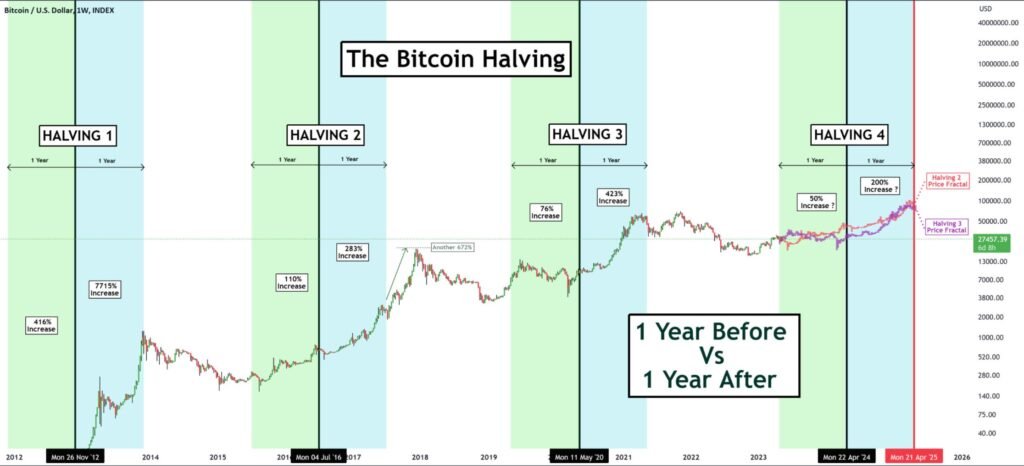

Since Bitcoin’s inception in 2009, there have been three halving events, each marked by a reduction in the block reward. The first halving occurred in November 2012, reducing the reward from 50 to 25 bitcoins per block. The second halving took place in July 2016, cutting the reward to 12.5 bitcoins. The most recent halving in May 2020 further reduced the reward to 6.25 bitcoins. With the upcoming halving in April 2024, the reward will be halved once again to 3.125 bitcoins per block.

Future Outlook and Predictions:

Bitcoin halving events have historically been associated with positive price movements in Bitcoin. The reduction in the supply issuance rate highlights Bitcoin’s scarcity, attracting demand and potentially driving up its value. Looking ahead, experts and investors anticipate a bullish outlook for Bitcoin post-halving. Price predictions suggest that Bitcoin could reach significant milestones, with projections ranging from $100,000 to $200,000 by the end of 2024.

Impact on Miners and Industry Dynamics:

Bitcoin halving not only affects the value of Bitcoin but also has implications for miners and the mining industry. The reduction in block rewards can impact miners’ profitability, especially for smaller operations. As the block rewards decrease, miners may need to optimize their operations, upgrade equipment, or join mining pools to remain competitive. Larger mining operations with economies of scale may have an advantage in this environment, potentially leading to industry consolidation.

Regulatory Environment and Institutional Adoption:

The regulatory landscape and institutional adoption of Bitcoin also play a significant role in shaping the future of cryptocurrency post-halving. Regulatory clarity and acceptance of Bitcoin as a legitimate asset class can boost investor confidence and drive further adoption. The potential approval of a Bitcoin Spot ETF by regulatory bodies could open up new avenues for investment and increase liquidity in the market. Institutional interest in Bitcoin as a hedge against inflation and economic uncertainty could further propel its value post-halving.

The conclusion from my side:

In conclusion, Bitcoin halving is a pivotal event that influences the supply, value, and dynamics of the cryptocurrency market. With each halving, Bitcoin’s scarcity increases, potentially driving up its value over time. Investors and experts remain optimistic about the future of Bitcoin post-halving, expecting continued price appreciation and potential milestones in the cryptocurrency’s value. The impact on miners, industry dynamics, regulatory developments, and institutional adoption will all contribute to shaping the future of Bitcoin in the post-halving era.

TLDR of the article:

1. Bitcoin halving is a key event in the cryptocurrency world, occurring every four years to reduce the reward miners receive for validating transactions.

2. The upcoming halving in April 2024 will cut the reward to 3.125 bitcoins per block, emphasizing Bitcoin’s scarcity and potential value appreciation.

3. Historical halving events in 2012, 2016, and 2020 have been associated with positive price movements in Bitcoin.

4. Post-halving, experts predict a bullish outlook for Bitcoin, with price projections ranging from $100,000 to $200,000 by the end of 2024.

5. Halving impacts miners, industry dynamics, regulatory environment, and institutional adoption, shaping the future of Bitcoin in the cryptocurrency market.

Bibliography

“Bitcoin Halving: Everything You Need to Know” – CoinDesk

“The Economics of Bitcoin Mining or, Bitcoin in the Presence of Adversaries” – Joshua A. Kroll, Ian C. Davey, and Edward W. Felten

“Bitcoin Halving: What You Need to Know” – Cointelegraph

“Bitcoin Halving: A Guide for the Perplexed” – Harvard Business Review